Press Releases

Moran Applauds House Passage of ‘One, Big, Beautiful Bill’ to Reignite the American Dream

Washington, D.C.,

May 22, 2025

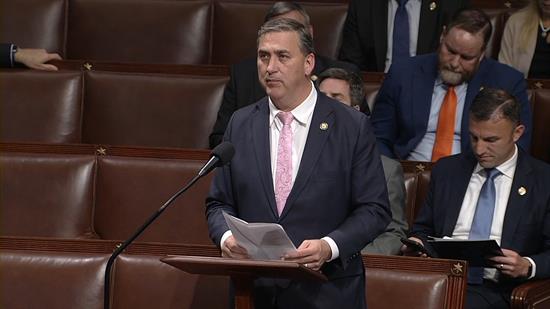

Today, Congressman Nathaniel Moran (R-TX-01) released the following statement after the House passed the “One, Big, Beautiful Bill,” sending it to the Senate for consideration:

Washington, D.C.—Today, Congressman Nathaniel Moran (R-TX-01) released the following statement after the House passed the “One, Big, Beautiful Bill,” sending it to the Senate for consideration: “With today’s passage of the One, Big, Beautiful Bill, House Republicans delivered on the promises we made to the American people. This legislation puts working families, small businesses, and rural communities back at the center of our economic future—right where they belong. “In Texas’ First Congressional District, where the median income is just $62,000, a family of four was on track to see their taxes increase by over $1,100—a staggering 22% hike—had we failed to act. That’s six weeks’ worth of groceries. That’s money that could fix a truck, invest in a small business, or be saved for a child’s future. By passing this bill, we’ve protected those hard-earned dollars. But more than that, we’ve advanced liberty by empowering families, workers, and small businesses to thrive without the government taking more of what they earn. This bill expands opportunity, restores dignity in work, and strengthens the American Dream. That’s worth fighting for.”

Background on the “One, Big, Beautiful Bill”: For Small Businesses:

For Families:

For Rural America:

For the Broader Economy:

What’s at Stake:

###

|